We’ll go over the details of how to finish Type SS-4 further more down below, but ahead of we do, There are many other critical matters to debate very first.

Dealing with difficulties although populating your site with people and battling to manually create meaningful names? Streamline your system with our Consumer Profile Generator.

Hi Kay, you’re really welcome! Each individual LLC will need its individual EIN. I feel There exists a typo in the sentence about both you and your partner. Feel free to talk to once more if I skipped just about anything.

You are really welcome Yado! The IRS is really backed up. The current problem is introducing big delays… and December and January may also be really hectic months. Please see Oleksii’s reply beneath. It’s actually greatest to simply wait and be patient. Sending in various SS-4s just isn't a good suggestion. It can cause challenges. In all of my knowledge with the IRS, the IRS doesn’t skip paperwork or drop factors. It just will take extended than expected often. And what’s occurring at this time on the planet hasn't took place before.

The IRS challenges EINs to foreigners on a regular basis and this is That which you should enter if you don’t have an SSN or ITIN.

It depends. Should you have a US tax filing necessity or you need a service provider processor, then an ITIN is going to be desired.

I called the IRS plus they explained to me to carry at stake although they will Examine the position of my document.

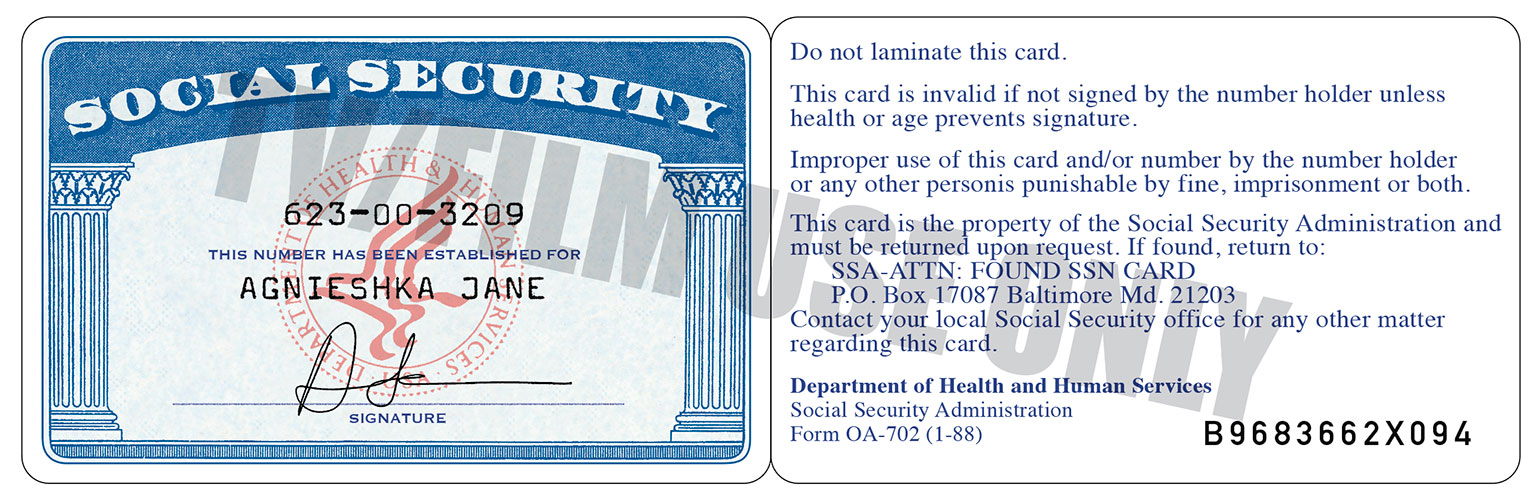

You can find somewhere around 420 million numbers available for assignment. On the other hand, the previous SSN assignment method confined the number of SSNs available for issuance to people by Each individual point out. Transforming the assignment methodology prolonged the longevity on the 9 digit SSN in all states.

I need to find out if Now we have a colleague in United states with SSN can he/she implement online for EIN for out LLC? or they need to be members of LLC to have the ability to implement EIN online?

Note: Most foreigners received’t have employment tax legal responsibility, so this segment may not be relevant. Most foreigners will just leave the box unchecked.

Like prepaid debit cards, flex cards are loaded realdocsglobal.com by using a predetermined amount of money to protect expenses inside a specified time. But In addition they include procedures on what The cash can be utilized for.

In case you are distributing SS-4 by mail, you don’t need to enter a fax number. It is possible to leave this here information about social-security-card-online-ssn empty.

In an effort to appear to be reliable, They might make use of the name of the actual SSA employee or ship what seems like an Formal SSA letterhead hooked up to an email or text concept. To feign legitimacy, They could recite “badge numbers” as well as realdocsglobal.com make copyright versions on the IDs federal staff use to realize entry to governing administration buildings.

And even if you have an ITIN, quite a few foreigners get an error concept (an IRS reference number) at the end of the online EIN application and end up needing to use Kind SS-4.